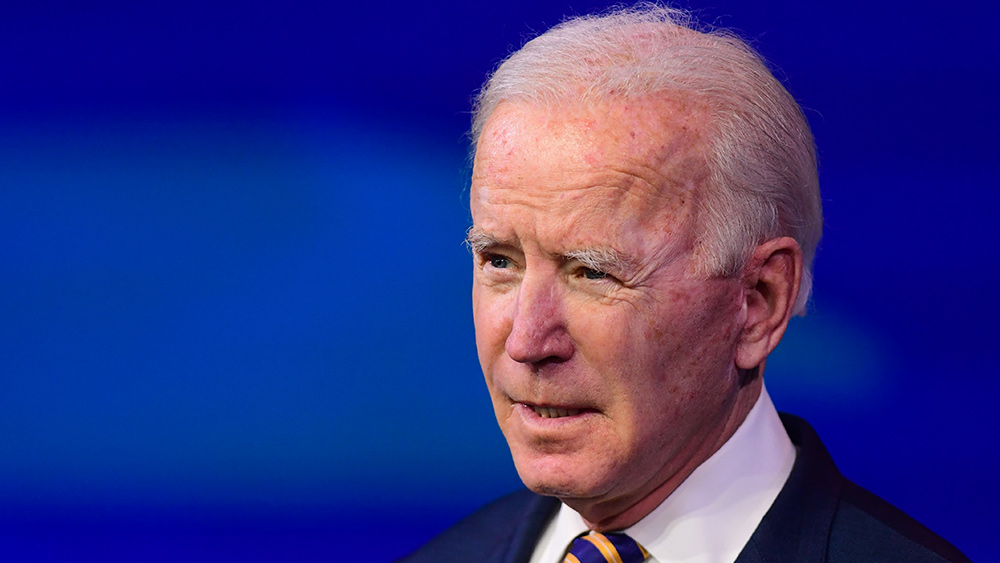

Business groups oppose Joe Biden’s “dangerously misguided” plan to pay for $2.3 trillion infrastructure bill by raising taxes

04/07/2021 / By Arsenio Toledo

President Joe Biden is asking Congress to pass his $2.3 trillion jobs and infrastructure plan. Many major business organizations are opposing the costly plan, calling it “dangerously misguided.”

The unified defiance against Biden’s plan signals the strength of the opposition the White House is up against as it struggles to promote the president’s spending package. One of the largest organizations leading the push to strike down the infrastructure plan is the Chamber of Commerce, a pro-business lobbying group.

The Chamber of Commerce agrees that America’s failing infrastructure needs to be addressed, but disagrees with the significantly large tax increase that will be required to pay for it. In a press release, the Chamber of Commerce called for removing the tax hike in the infrastructure plan.

“Properly done, a major investment in infrastructure today is an investment in the future, and like a new home, should be paid for over time – say 30 years – by the users who benefit from the investment,” said the Chamber of Commerce in its statement. “We strongly oppose the general tax increases proposed by the administration which will slow the economic recovery and make the U.S. less competitive globally – the exact opposite of the goals of the infrastructure plan.”

Biden’s $2.3 trillion spending bill, called the American Jobs Plan, includes investments in renewable energy, expansion of broadband capabilities and the development of highways and housing projects. The money to be set aside for the bill is to be spent over the course of eight years.

The White House wants Congress to approve a significant tax increase to pay for Biden’s spending plan. This tax increase involves, among other things, raising the corporate tax rate from 21 to 28 percent. (Related: “The largest tax hike in generations” could pay for up to 75% of Biden’s next spending plan.)

The White House claims that this tax increase will raise up to $3 trillion – $700 billion more than what the bill wants to spend.

In its opposition to the bill and the tax hike, the Chamber of Commerce is calling on Democrats and Republicans to come together and find an acceptable middle-ground.

“We urge both Democrats and Republicans to avoid further partisan gridlock and provide productive solutions to get an infrastructure bill passed this year.”

Other business organizations and notable individuals skeptical of Biden’s infrastructure plan

The Business Roundtable, a pro-business nonprofit, has also opposed the tax increases needed to pay for the infrastructure plan.

“Business Roundtable strongly opposes corporate tax increases as a pay-for for infrastructure investment,” said Business Roundtable President and CEO Joshua Bolten. “Policymakers should avoid creating new barriers to job creation and economic growth, particularly during the recovery [from the Wuhan coronavirus pandemic].”

“To the extent that infrastructure investment, given its unique economic benefits and the need for a rapid recovery from COVID-19, is deficit-funded in the short term, Congress should set a course for steady, reliable funding for infrastructure over the long term,” continued Bolten, echoing the Chamber of Commerce’s counter-proposal to funding for the infrastructure plan.

The National Federation of Independent Business (NFIB), the largest nonprofit in the country that advocates for the welfare of small businesses, has also opposed raising the corporate tax rate.

“America’s small businesses are the third-largest economy in the world, and they have been severely harmed by the pandemic and government shutdowns,” said NFIB President and CEO Brad Close in a statement. “We recognize this is only ’round one’ [of the fight against the bill] and will remain steadfast in opposing any tax hikes that could hurt the efforts of small businesses to keep their doors open and their employees on payroll.”

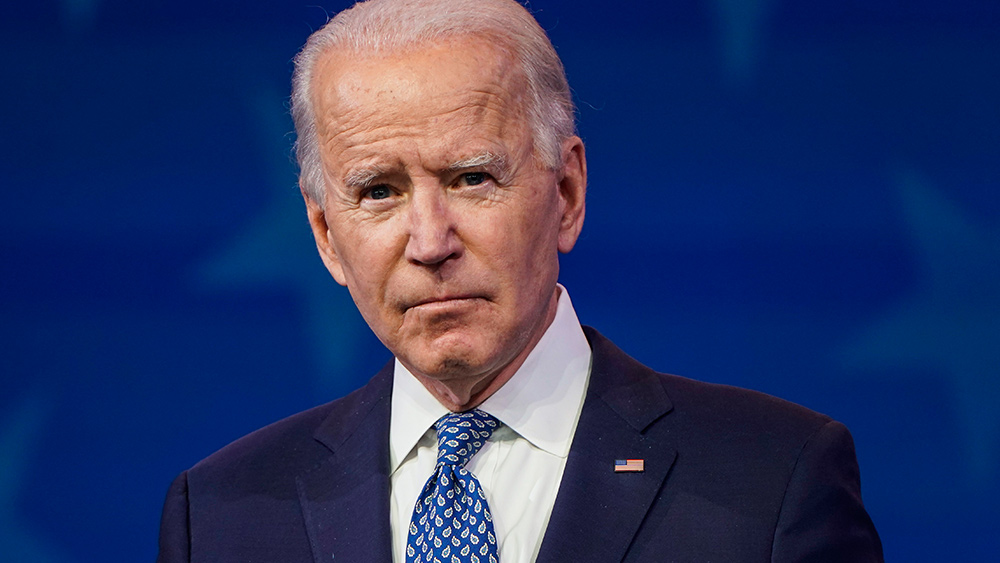

Republicans are expected to put up a strong fight against the bill’s excesses. Senate Minority Leader Mitch McConnell of Kentucky has already stated that he is “highly skeptical.”

“I’m going to fight them every step of the way, because I think this is the wrong prescription for Americans,” said McConnell. “That package that they’re putting together now, as much as we would like to address infrastructure, is not going to get support from our side.”

Learn more about Biden’s latest policy proposals, and all of the new taxes required to pay for them by reading the latest articles at JoeBiden.news.

Sources include:

Tagged Under: anti-business, Biden, big government, Business Roundtable, businesses, Chamber of Commerce, corporate tax, debt bomb, economy, government spending, infrastructure, Joe Biden, National Federation of Independent Business, politics, rigged, small businesses, tax, tax hike, Taxes, Twisted, White House

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 WHITE HOUSE NEWS